Watch out! The curve is moving toward a warning of recession. Yields are inverted between the 7-yr and 10-yr as well as the 20-yr and 30-yr. The downward slope that started at the long end now includes the middle of the curve. Talking heads call this mid-section "the belly of the curve."

Timing the Market: How to Profit with Yield Curves

Go to the Amazon.com link below for TIMING THE MARKET by Deborah Weir (Wiley, 2005). Email: DebWeir@WealthStrategies.bz Take her class at the NY Institute of Finance: nyif.com/courses/fimk_1014.html.

Wednesday, March 23, 2022

Friday, August 16, 2019

The yield curve inverted and some investors are scared. I never thought I'd ignore an inverted curve, but think about this. Interest rates increase before inverting and signaling a recession. Interest rates are at historic LOWS and do not curtail borrowing.

Look at these graphs from StockCharts.com. The curve inverted at a much higher rate before the stock market decline in 2000.

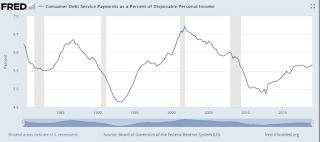

Neither the consumer nor corporations have trouble borrowing at these low rates.

The consumer will continue to drive this economy and stock market to new highs.

Look at these graphs from StockCharts.com. The curve inverted at a much higher rate before the stock market decline in 2000.

And again before the recession of 2007:

Neither the consumer nor corporations have trouble borrowing at these low rates.

The consumer will continue to drive this economy and stock market to new highs.

Tuesday, July 10, 2018

Monday, March 26, 2018

Now is the Time...

Now is the time to buy stocks.

When all 30 of the Dow decline at once, it is time to buy. That happened on the 22nd and we have had several instances of nearly all thirty going down last week.

The yield curve is steeper than before an the VIX has come down. Quality spreads have yet to narrow, but at least they have stopped widening.

Investors are beginning to realize that increasing tariffs is not a problem in an expanding global economy. The Smoot Holly Act in 1930 raised tariffs during a global recession. That is not the case now.

When all 30 of the Dow decline at once, it is time to buy. That happened on the 22nd and we have had several instances of nearly all thirty going down last week.

The yield curve is steeper than before an the VIX has come down. Quality spreads have yet to narrow, but at least they have stopped widening.

Investors are beginning to realize that increasing tariffs is not a problem in an expanding global economy. The Smoot Holly Act in 1930 raised tariffs during a global recession. That is not the case now.

Thursday, August 10, 2017

Is a stock market decline coming? All major indicators say, “Yes.” Investors are becoming cautious and taking risk out of their portfolios.

1. The bond market yield curve is flatter as investors sell 10-year Treasury notes and save their proceeds in cash.

2. Investors are selling low-quality bonds. There was so much talk about Tesla’s high-yield bond issue yesterday that people are starting to pay attention to credit ratings of firms that do not generate any cash.

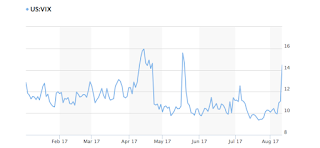

3. The volatility index is the easiest to read of all indicators. The VIX exploded 27% in one day.

All three indicators point to lower prices in the equity markets. This is a short-term correction which is normal for August.

1. The bond market yield curve is flatter as investors sell 10-year Treasury notes and save their proceeds in cash.

2. Investors are selling low-quality bonds. There was so much talk about Tesla’s high-yield bond issue yesterday that people are starting to pay attention to credit ratings of firms that do not generate any cash.

3. The volatility index is the easiest to read of all indicators. The VIX exploded 27% in one day.

All three indicators point to lower prices in the equity markets. This is a short-term correction which is normal for August.

Friday, November 11, 2016

Trickle Down Economics

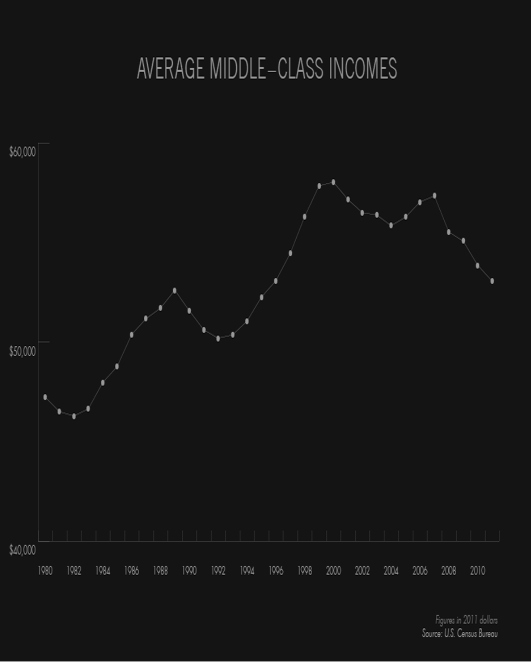

Trickle down economics works. It may not distribute the wealth evenly; the top 1% may receive more than the rest of the population. But the middle class benefits from a stronger economy. The new wealth does not ALL go to the super-rich.

Here’s how the middle-class benefited from increased government spending in 1983 and from lower taxes in 1986. Even with a recession in 1990, the middle-class was better off at the end of the century.

Source: Frontline

http://www.pbs.org/wgbh/frontline/article/the-state-of-americas-middle-class-in-eight-charts/

Here’s how the middle-class benefited from increased government spending in 1983 and from lower taxes in 1986. Even with a recession in 1990, the middle-class was better off at the end of the century.

Source: Frontline

http://www.pbs.org/wgbh/frontline/article/the-state-of-americas-middle-class-in-eight-charts/

Tuesday, May 03, 2016

Wednesday, February 03, 2016

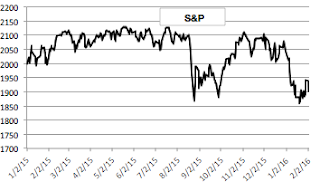

That excellent measurement of investor confidence, the volatility index, has been a big help in timing the stock market during the last twelve months. These two data series are mirror images of each other. As it says in my book, TIMING THE MARKET (published by Wiley & Sons) sell stocks as the VIX rises and repurchase them as it falls.

Tuesday, February 03, 2015

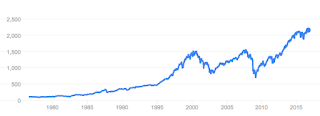

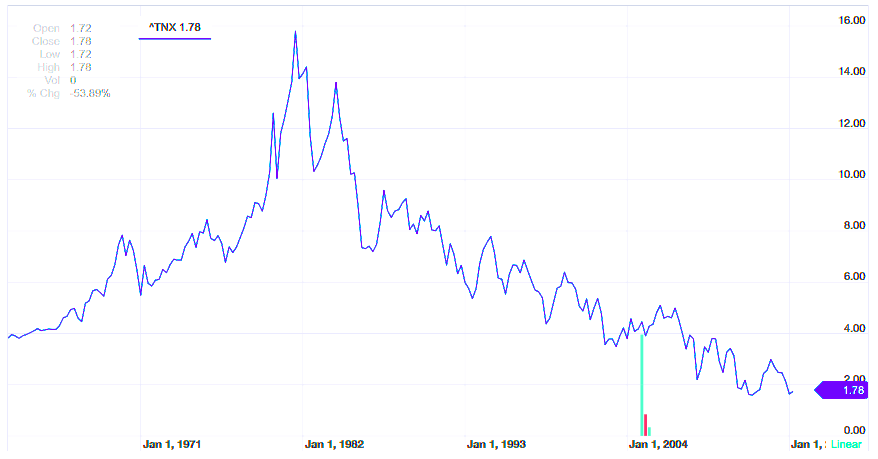

Historically low Treasury yields will force investors into the equity market. With the S&P delivering 1.87% dividend yield and Treasuries at just 1.78%, many investors will choose the former.

Note the peak Treasury yield of 16% in 1982. We have had a 33-year decline in those yields that could presage a long period of rising yields. Since rising bond yields depress bond prices, investors will prefer equities. (Graph courtesy Yahoo.com)

Note the peak Treasury yield of 16% in 1982. We have had a 33-year decline in those yields that could presage a long period of rising yields. Since rising bond yields depress bond prices, investors will prefer equities. (Graph courtesy Yahoo.com)

Subscribe to:

Posts (Atom)